Secondary Research Services: A Complete Guide to Strategic Market Analysis

In today’s data-rich environment, businesses rarely struggle with access to information. Instead, the real challenge lies in organizing scattered data into clear, decision-ready insights. Secondary Research Services help organizations interpret existing information systematically and transform it into structured intelligence for strategic planning.

This guide explains what Secondary Research Services are, how they work, when they are used, and their advantages and limitations.

What Are Secondary Research Services?

Secondary Research Services involve analyzing existing data sources to answer business questions—without conducting new surveys, interviews, or field studies.

Rather than gathering fresh (primary) data, secondary research relies on previously published or recorded information and applies structured methodologies to extract insights.

Core Elements of Professional Secondary Research:

Defining the specific business objective

Identifying relevant and credible data sources

Collecting and organizing available information

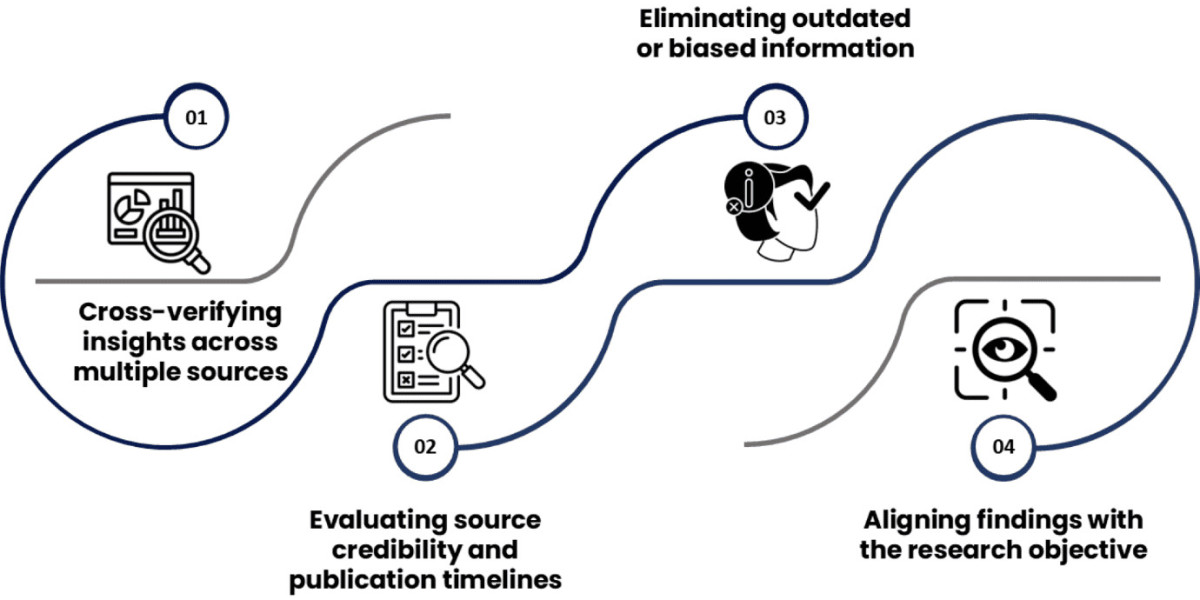

Cross-validating findings using triangulation

Documenting assumptions and limitations

Presenting structured, decision-focused outputs

The objective is not just data collection, but building reliable intelligence that supports informed decisions.

When Do Businesses Use Secondary Research Services?

Organizations typically use secondary research when they need cost-efficient, timely, and evidence-based direction.

1. Market Entry and Expansion

Before entering a new region or industry segment, companies often need clarity on:

Market demand and growth potential

Regional performance variations

Regulatory considerations

Distribution and route-to-market models

Secondary research provides an initial evidence base to evaluate feasibility before committing resources.

2. Competitive Intelligence

Secondary research helps analyze competitor activities such as:

Product portfolios

Pricing structures (where publicly available)

Partnerships and acquisitions

Hiring patterns

Expansion strategies

By identifying trends and signals, organizations gain a broader understanding of the competitive landscape.

3. Market Sizing and Demand Estimation

Market sizing often requires combining multiple datasets to estimate:

Total market value

Growth rates

Serviceable available market (SAM)

Serviceable obtainable market (SOM)

Where data transparency is limited, triangulation methods help create reasonable ranges and scenario models.

4. Investment and Strategy Evaluation

Investors and strategy teams use secondary research to assess:

Industry structure and value chains

Margin dynamics

Demand drivers

Structural and regulatory risks

This supports more informed capital allocation decisions.

5. Procurement and Supplier Mapping

Secondary research also supports:

Supplier landscape analysis

Certification and compliance checks

Capacity indicators

Risk screening

This allows companies to evaluate potential suppliers before initiating direct engagement.